The Genesis of Capital Markets in the United States: Alexander Hamilton

Introduction

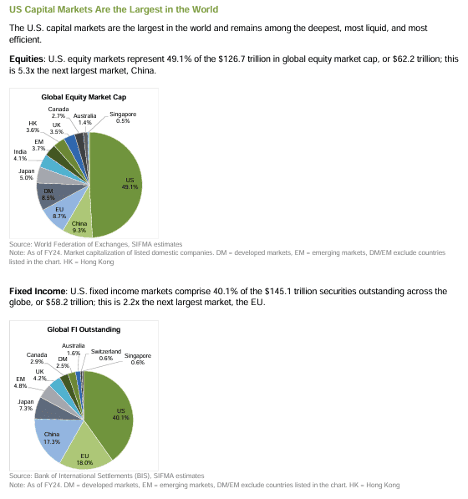

The United States public capital markets are the largest and deepest globally, enabling innovation, investment, and growth across the economy. SIFMA

Their roots reach back to the first years of the Republic, when the new government faced heavy war debts and fragile public finances. In this environment, Alexander Hamilton emerged as the first Secretary of the Treasury and established the foundations of the nation’s financial system. U.S. Department of the Treasury

As the first Secretary of the Treasury, Hamilton developed policies that established the creditworthiness of the United States and laid the groundwork for organized markets. His First Report on the Public Credit (1790) outlined a plan for the federal government to assume state debts and fund obligations through new securities, creating stability and investor confidence. To further strengthen the financial system, Hamilton advocated for the creation of the First Bank of the United States, which provided a national currency, managed government funds, and offered credit to support commerce.

These measures transformed public obligations into widely held market instruments and set enduring norms for credibility, liquidity, and fiscal stewardship that continue to shape today’s public capital markets. Library of Congress

In this article, we explore how Hamilton’s contributions still shape the structure and principles of today’s public capital markets in the United States.

Chapter 1: Hamilton’s Vision for a Financially Strong Nation

After the Revolutionary War, the United States faced a fragile economy, severe inflation, and large debts at both the state and federal levels. Establishing financial stability was not only an economic priority; it was essential for political legitimacy and national survival. Alexander Hamilton understood that a stable financial foundation would allow the United States to command respect abroad and encourage growth at home.

Hamilton’s first major initiative as Secretary of the Treasury was his First Report on the Public Credit (1790). In it, he argued that the federal government should assume the debts of the states and fund outstanding obligations through new securities backed by the national government. This policy unified the country’s finances, centralized creditworthiness, and reassured creditors that the United States would honor its commitments.

The move was controversial at the time, but its long-term effect was profound. By consolidating debt under the federal government, Hamilton created a single, credible borrower in place of thirteen separate states with uneven reputations. This consolidation strengthened public confidence and helped establish an active market for U.S. securities.

Hamilton believed that public credit was not merely a way to settle past debts but also a tool for future growth. By turning obligations into transferable securities, he established the groundwork for early public securities markets in cities such as Philadelphia and New York. His approach emphasized fiscal credibility, government backing, and a reliable system of repayment. These same principles—credibility, liquidity, and investor confidence—remain fundamental to modern markets today.

Section 2: The Creation of the First Bank of the United States

Hamilton argued that the nation required a central financial institution to manage government funds, stabilize the currency, and expand credit to support commerce. In his Report on a National Bank delivered to Congress in December 1790, he outlined a bank with mixed public-private ownership, the ability to issue notes redeemable in specie, and a mandate to act as fiscal agent for the federal government. His design emphasized nationwide reach and prudent supervision so that banknotes would circulate widely and reliably, improving trade and tax collection.

Congress enacted “An Act to Incorporate the Subscribers to the Bank of the United States” on February 25, 1791, establishing a twenty-year charter with authorized capital of 10 million dollars, of which the federal government would subscribe one-fifth and private investors the remainder. Shares were available to the investing public, and the government’s subscription was financed in part by a loan from the Bank itself. The charter empowered the Bank to conduct discounting and deposit operations, issue notes, and open branches, while prohibiting it from purchasing federal debt directly beyond specified limits. These guardrails reflected Hamilton’s emphasis on credibility and discipline.

In practice, the First Bank served as the government’s depository and payments hub, supplied a widely accepted circulating medium through its notes, and helped restrain over-issuance by state banks through redemption pressure. These functions enhanced liquidity and confidence in United States credit, supported the trading of government securities, and encouraged the development of an organized market for financial claims. The Bank’s stock and the nation’s funded debt became important early securities, drawing investors into the young country’s public markets and setting norms of transparency, convertibility, and prudent leverage that continue to influence modern market structure.

During the Revolutionary War, the Continental Congress lacked independent taxing authority and relied on state requisitions, paper emissions, and foreign loans to fund operations. The Articles of Confederation required that taxes be laid and collected by state legislatures, which impeded reliable revenue for the central government. Continental currency depreciated severely by 1779, giving rise to the phrase “not worth a Continental,” and circulation largely ceased by 1781. Congress also turned to loans from France and the Netherlands to meet expenses. Arrears in pay and shortages in provisions for the Army became persistent grievances, recorded in memorials that demanded settlement of back pay and compensation for deficiencies in rations and clothing. The First Bank directly addressed these structural weaknesses by creating a centralized fiscal agent with specie-redeemable notes, a uniform payments mechanism for federal receipts and disbursements, disciplined credit provision, and a credible balance sheet that supported regular borrowing at lower cost. Those capabilities reduced the reliance on ad hoc requisitions and unstable paper issues that had hampered wartime procurement and payments.

Chapter 3: Hamilton and the Birth of Public Debt as a Market Instrument

Hamilton’s funding program turned scattered Revolutionary-era IOUs into standardized, interest-bearing securities that could be bought and sold. In the Report Relative to a Provision for the Support of Public Credit he proposed full federal funding and voluntary conversion of legacy certificates into new federal “stock,” which would restore credit and create a predictable stream of payments for investors. Congress enacted this vision in the Funding Act of 1790, which offered holders of domestic debt a choice of new instruments. The statute created three main tranches: two-thirds converted into 6 percent stock with immediate interest, one-third into deferred 6 percent stock beginning interest in 1801, and separate 3 percent stock for arrears of interest. The law also pledged specific federal revenues to service this debt, which strengthened credibility and market appeal.

A companion measure, the Act Making Provision for the Reduction of the Public Debt (August 12, 1790), established a formal sinking fund and empowered the government to purchase federal debt in the market when resources permitted. This created a sustained mechanism to support prices and signal repayment discipline to investors. Hamilton’s subsequent reports detailed how customs duties and other pledged revenues would feed this program and how purchases would be executed to retire obligations over time.

By assuming portions of state debts and converting them into federal obligations, Congress also increased the outstanding supply of uniform, negotiable securities. The Funding Act specified state subscription limits and standardized terms across jurisdictions, which improved price discovery and tradability. The combination of having a credible source of revenue backing the commercial instrument, a redemption framework, and standardized instruments invited participation from a broader investing public and created the conditions for regular trading in U.S. debt.

The market response was immediate. Contemporary evidence shows that by late 1790 and into 1791, securities markets in Philadelphia and New York quoted prices daily for the restructured U.S. debt and for shares of the Bank of the United States. The presence of actively traded, government-backed instruments provided both collateral and benchmarks for valuing other claims, which accelerated the growth of organized securities dealing in the early Republic.

Hamilton’s approach established durable principles that remain visible today. Marketable U.S. government securities remain the nation’s foundational safe asset and a reference point for pricing and liquidity across public markets, a direct legacy of the funding system that transformed obligations into widely held, tradable instruments.

Chapter 4: Encouraging Manufacturing and Market Expansion

Hamilton argued that long-term national prosperity required a strong base of manufacturing alongside agriculture and trade. In his Report on the Subject of Manufactures, Hamilton set out how domestic industry could raise productivity, expand employment, and increase national self-reliance through a program of targeted support and predictable policy. He proposed a mix of tools, including protective and revenue tariffs, “bounties” for promising sectors, and careful tax design to lower input costs for producers.

Several of the principles in the report built on measures already adopted by the First Congress. The Tariff Act of 1789 established duties on imports both to service federal obligations and to encourage domestic production. Hamilton’s report elaborated how a calibrated tariff schedule, combined with selective reductions on raw materials and machinery, could help infant industries achieve scale without undermining overall commerce.

Hamilton also emphasized the importance of encouraging invention and the diffusion of useful arts. The Patent Act of 1790 created a federal process to grant inventors time-limited exclusive rights, which he viewed as a practical incentive for private investment in new techniques and machinery. This legal framework helped align rewards with risk for entrepreneurs and financiers who supplied capital to early industrial ventures.

The policy vision translated into action in places such as Paterson, New Jersey, established in the early 1790s as the nation’s first planned industrial city. Centered on the Great Falls of the Passaic River, Paterson’s waterpower and industrial layout illustrate how Hamilton’s program linked infrastructure, technology, and finance to build manufacturing capacity that could compete with imports.

These recommendations mattered for capital formation and public markets. Expanding manufacturing created demand for fixed investment in mills, canals, machinery, and inventory, which in turn relied on predictable credit and tradable financial claims. Scholarly evidence shows that, as federal debt and bank shares began trading actively in the early 1790s, securities markets broadened to support enterprise finance. Hamilton’s policies helped supply credible benchmarks and investable assets that lowered financing frictions for the emerging industrial economy.

Chapter 5: Legacy in Modern Capital Markets

Hamilton’s program established habits of financial credibility that still define the U.S. public capital markets. The conversion of obligations into widely held federal securities created a template for a deep market in government debt, which today remains a cornerstone of global finance. U.S. Treasury securities are widely regarded as low risk, very liquid, and essential to funding the federal government. They also provide key pricing references used by investors and institutions throughout public markets.

Central banking functions that Hamilton advocated in embryonic form now operate through the Federal Reserve System, which was created in 1913 to promote financial stability and an elastic currency. The Federal Reserve conducts open market operations in Treasury securities to implement monetary policy and support market functioning, which helps transmit policy to broader financial conditions. These operations depend on the depth and reliability of the U.S. Treasury market, reinforcing the modern role of federal obligations as the nation’s benchmark safe asset.

Modern disclosure and investor-protection frameworks, while products of the twentieth century, align with Hamilton’s insistence on credibility and regular payment. The federal securities laws administered by the U.S. Securities and Exchange Commission require transparent offering and trading practices that support investor confidence in public markets for both debt and equity. Together, these structures connect public finance, central banking, and securities regulation in a way that traces back to Hamilton’s core premise: credible obligations and dependable institutions attract capital and sustain broad participation in organized markets.

Chapter 6: Lessons for Today

1) Credible public obligations anchor market confidence.

Hamilton treated the government’s promises as inviolable and paired them with dedicated revenues. Today, marketable U.S. Treasury securities remain the nation’s benchmark for safe asset and a reference point for pricing and liquidity across public markets.

2) Standing liquidity backstops support orderly trading.

Hamilton’s system relied on credible institutions to stabilize finance. Modern central banking uses tools such as open market operations and the Standing Repo Facility to maintain smooth funding and transmit monetary policy, which supports functioning in Treasury and related markets.

3) Transparency and standardized disclosure attract long-horizon capital.

Regular payment was only part of Hamilton’s formula. Predictability and clarity mattered as well. Modern securities laws administered by the U.S. Securities and Exchange Commission require disclosures and fair dealing that help investors assess risk and price securities. Public filings through EDGAR operationalize this principle at scale.

4) Standardization of instruments lowers financing frictions.

Hamilton’s conversion of scattered obligations into uniform, tradable claims improved price discovery. Today, standardized Treasury bills, notes, and bonds provide a consistent set of instruments for saving, hedging, and collateral, which in turn supports broader capital formation.

5) Market structure requires continuous attention to resilience.

Hamilton paired ambition with guardrails. Contemporary research highlights how dealer capacity, settlement, and funding conditions can affect Treasury market function, which implies ongoing work on market design and operational readiness during stress.

6) Broader participation strengthens capital formation.

Hamilton’s aim was national prosperity built on credible finance. Modern regulators emphasize investor protection, fair access, and efficient markets so that a wider set of participants can supply and obtain capital in public markets. This principle aligns with Dream Exchange’s focus on expanding participation among smaller issuers and investors through trustworthy, rules-based market infrastructure.

Conclusion

Alexander Hamilton’s program created the habits and institutions that still sustain the United States public capital markets. By restoring public credit, converting fragmented obligations into standardized, interest-bearing securities, and establishing a capable fiscal agent in the First Bank of the United States, he turned uncertainty into investable claims and regularized the government’s financial operations. These steps supplied a safe asset that has been deemed credible and trustworthy, improved liquidity, and encouraged organized trading. The same pillars of credibility, standardized instruments, and dependable administration continue to anchor modern markets.

For Dream Exchange, the lesson is clear. Markets thrive when participants trust the obligations at their core, when rules are predictable, and when information and settlement work smoothly. Our goal is to apply those principles, through the passage of the Main Street Growth Act, so that a wider range of issuers and investors can access orderly public markets with confidence, while honoring the standards of transparency and responsibility that Hamilton advanced.